If you’re new here, welcome to Delivered, a newsletter covering the intersection of content & commerce. If you haven’t already, subscribe to get all posts straight to your inbox.

If you were in the trenches for Black Friday/Cyber Monday this past week, hopefully you’re enjoying a few peaceful days before the Christmas holiday rush. The BF/CM headlines have been coming in all week, and I initially started today’s newsletter intending to round them up before getting to something meatier. Then I realized that this year’s facts and figures warrant analyses of their own. Keep reading for the standout headlines from this year’s BF/CM bonanza, plus a few hot takes.

Adobe reported that consumers made $10.8 billion in purchases on Black Friday, and $13.3 billion on Cyber Monday, up 10% and 7% YoY, respectively. Shopify merchants hit a record $11.5 billion in gross merchandise volume over BF/CM weekend, up 24% YoY. (Shopify stock is slowly making its way back to 2021 levels.)

Amazon also shared positive, but vague, results, declaring its BF/CM period “the biggest ever” compared to the same 12-day period in previous years. The ambiguity doesn’t instill confidence, but growth is growth, I guess.

Top products reported by Adobe included the Dyson Airwrap, espresso machines, bedding, and so many toys: Lego sets, Harry Potter and Wicked paraphernalia, and stuffed animals. FWIW, I bought my daughter blocks.

The most standout stats to me, and the ones I suspect have changed the most in the last couple of years (espresso machines were a hot product back when I was in the BF/CM content mines in 2019) are the factors surrounding consumers’ path to purchase. How did people find out about deals? How did content that marketed sales perform? What devices did shoppers transact on?

According to Adobe, traffic to retail sites from GenAI chatbots was up by 1,800% YoY, a comically large jump that’s mostly a reminder of how chatbots came out of nowhere (i.e., small base) and became more functional over the last year. In a survey of 5,000 consumers, 20% said they used chatbots to find deals this year—1 out of 5 is high! It’s a relatively small sample size but not something that should be ignored, especially by publishers who consider GenAI chatbots a threat to their search traffic.

Social media influencers are gaining traction, with Adobe attributing 20.3% of retail sales to them on Cyber Monday, up 6.8% YoY. Its data showed that people are six times more likely to make a purchase after seeing influencer content than non-influencer content, like an in-feed ad, on social media. Tailor your paid budgets accordingly.

Speaking of influencers, TikTok Shop generated more than $100 million in sales on Black Friday, driven by over 30,000 livestreams. That doesn’t net out to that much revenue per livestream, but it’s a significant moment for live social commerce, which people keep saying is going to catch on in the US like it has in China. An old boss of mine really tried to make live shopping happen in 2021. That was before TikTok was mainstream, and I can’t see it being successful on any platform other than TikTok (Instagram is the obvious next best choice but its commerce products have never really caught on). I personally find TikTok Shop a little too shady to be sustainable—it keeps surfacing Birkenstock clogs and On sneakers to me for $100 less than their MSRP—but I’ll have to dig into it more. If it’s too good to be true…it probably is.

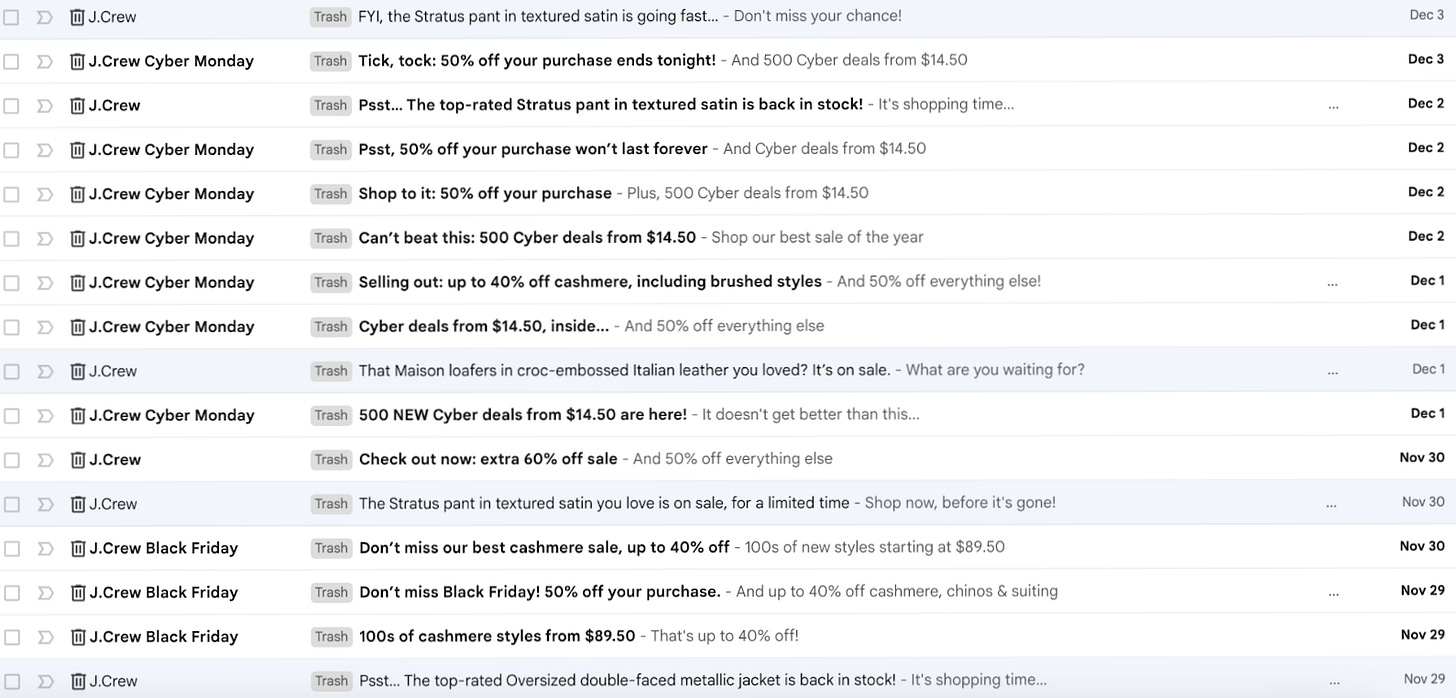

If you feel like you got a lot more emails in your inbox this year, you definitely did: Salesforce reported that retailer email sends were up 8% YoY. As inboxes become more crowded, personalization will become even more crucial to both publishers and retailers looking to stand out. Anecdotally, I more often click on retailer emails that tell me an item I was looking at is on sale, compared to ones announcing general sales.

Mobile commerce is finally becoming the default for many shoppers. Adobe reported that 57% of online sales came through a mobile device on Cyber Monday. In 2019, only 33% of Cyber Monday online sales came through a mobile device (a 73% gain). Yes, older consumers are getting more comfortable making purchases from their small screens, but don’t forget that young people who grew up with mobile phones are starting to earn more money and spend it during Cyber Week. And it’s this same demographic that’s getting their product recommendations from social media influencers.

In an interview with

of Feed Me, of The Love List shed light on her newsletter’s Black Friday strategy. She shared that brands pay for both inclusion & rank in her deal round-up, noting that specific product call-outs higher on the page cost more than a quick two-sentence summary further down. Sponsored inclusion is becoming increasingly common in commerce content, especially during times like Cyber Week when competition for that last click is high. It works particularly well with individual creators whose community trusts them to work with brands they genuinely want to work with and who are essentially their own sales team. Many mainstream publishers employ a similar kind of sponsored affiliate strategy, but it’s hard to execute and scale when you have a traditional ad business and territorial salespeople, writers who want to maintain editorial independence, and a standards & practices team that isn’t comfortable with the level of disclosure.

And finally… I’m guessing that publishers who rely heavily on Google to drive traffic to their sites didn’t fare as well this BF/CM as in past years, given the algorithm changes affecting affiliate sites and how crowded the product recommendation space has gotten. I noticed that Google’s own shopping widgets took up much more real estate on sale-related SERPs this year, as did links to Reddit posts crowdsourcing various deals. Diversifying traffic sources remains more important than ever, and publishers are going to have to get creative with how they break through the noise on social and email. Is partnering with influencers the path forward? We’ll save that for another newsletter.

Thanks for reading. If you have any other Black Friday/Cyber Monday story lines to share, or tips for what to cover in a future newsletter, email me at elaheh.nozari@gmail.com.

Elaheh